Indonesia investment updates - Establishing a presence in Indonesia: what you need to know

Date Published: 28 January 2020

Date Published: 28 January 2020

Authors and Contributors: Jimmy Yap, Daphne Tan, and Lai Zheng Yong.

This article is the second in CNPUpdate’s new series on Indonesia Investment Updates, and aims to provide you with a general overview of the laws and regulations governing foreign investments into Indonesia.

Generally speaking, you can enter the Indonesian market by:

There are other types of representative offices. For example, if you are in the construction industry, you may wish to consider establishing a foreign construction company representative office (also known as a Badan Usaha Jasa Konstruksi Asing or “BUJKA”), and if you are in the trade industry, a foreign trade representative office (also known as a Kantor Perwakilan Perdagangan Asing or “KP3A”). However, for the purposes of this article, we will only consider the KPPA.

Whether you should establish a KPPA or incorporate a PT PMA depends on your objective. On the one hand, a KPPA is simply a representative office established by a company that has already been incorporated outside of Indonesia. A KPPA is not a separate legal entity, and cannot engage in commercial or revenue-generating activity or participate in the management of any company in Indonesia. Although it is possible for a KPPA to refer potential business transactions back to its foreign parent company, do remember to obtain tax advice as to whether, for example, withholding taxes may apply. Once you have received the relevant approvals, you will be granted a KPPA licence, which has an initial validity period of 3 years. You can apply to extend your KPPA licence twice, with each extension having a maximum period of 1 year.

A PT PMA, on the other hand, is a limited liability company. A PT PMA can sue and be sued in its own name, and own certain rights and assets. Unlike a KPPA, a PT PMA can engage directly in sales and revenue-generating activities provided that the necessary licences and permits have been obtained and exist in perpetuity. Note also that a PT PMA must have at least one director, one commissioner, and two shareholders (to whom an annual report must be presented) at any one time, and that foreign investment regulations may limit the extent of foreign ownership in the PT PMA.

Establishing a KPPA is relatively simple and can take between 30 to 40 business days. First, the foreign company must first appoint an individual as its chief representative in Indonesia. Whilst this individual can be an employee of the foreign company, they cannot be a director of the foreign company (though they can, for example, be a director of the foreign company’s subsidiary). There is presently no requirement for the chief representative to be an Indonesian citizen.

Second, and once the foreign company has appointed a chief representative, an application may be made to the Indonesia Investment Coordinating Board (Badan Koordinasi Penanaman Modal or “BKPM”). The application can be made by the foreign company, its chief representative, or any person authorised by the foreign company or chief representative to do so by way of a power of attorney. The application should be supported by, among other things:

Third, and once BKPM has approved the foreign company’s application by providing the foreign company with a Letter of Approval, the foreign company can proceed to apply to the Tax Registry for a Tax ID Number.

The KPPA will have been duly established once these documents have been obtained. Thereafter, the KPPA can proceed to sponsor applications for the relevant work and residence permits (respectively, Izin Mempekerjakan Tenaga Kerja Asing or “IMTA”; and Kartu Izin Tinggal Terbatas or “KITAS”) for expatriates.

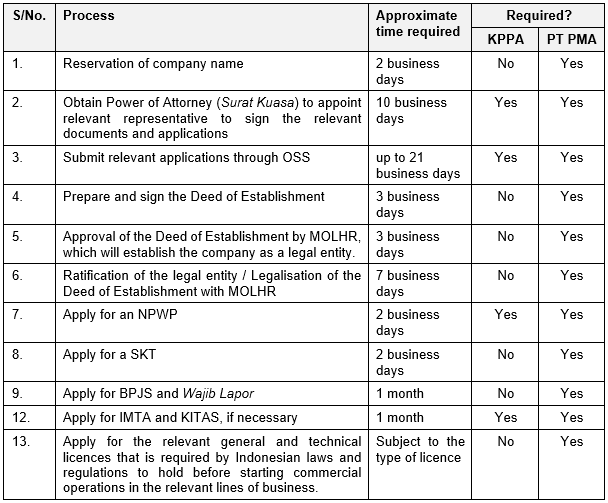

The process of incorporating an operationally-ready PT PMA involves several steps and applications to various authorities.

The first step is to conduct a name search and reserve the PT PMA’s name with Ministry of Law and Human Rights (“MOLHR”, which performs the functions of the registrar of companies), and prepare and sign a Deed of Establishment (also known as the Akta Pendirian Perseoran Terbatas). The Deed of Establishment is then signed by the founding shareholders of the PT PMA or their duly appointed attorneys in Indonesia before an Indonesian notary. The Deed of Establishment must, among other things:

The second step is to obtain MOLHR’s approval and ratification of the incorporation of the PT PMA. The Indonesian notary before whom the Deed of Establishment was signed will, after signing, lodge the signed Deed of Establishment with the MOLHR for the MOLHR’s review, approval, and ratification. Once the Deed of Establishment has been reviewed and approved by the MOLHR, MOLHR will issue the PT PMA with a letter stating that MOLHR has ratified the incorporation of the PT PMA. Only then is the PT PMA considered to have been validly incorporated. A shareholder’s resolution can thereafter be passed to amend the Articles of Association to conform with and/or incorporate the relevant terms of any joint venture or shareholders’ agreement.

Once incorporated, the PT PMA must hold its first extraordinary general meeting (“EGM”) within sixty (60) days. At this EGM, the shareholders of the company should ratify all acts of the promoters in relation to the abovementioned granting of powers of attorney, thereby verifying the legitimacy of the PT PMA as a legal entity. The first annual general meeting is to be held within six (6) months of the end of the PT PMA’s financial year.

The third step comprises applications for several mandatory documents, licences, and approvals that must be completed to enable the PT PMA to commence operations. This includes applying for, for example and among other things:

The following table summarizes the different steps in brief:

General disclaimer |